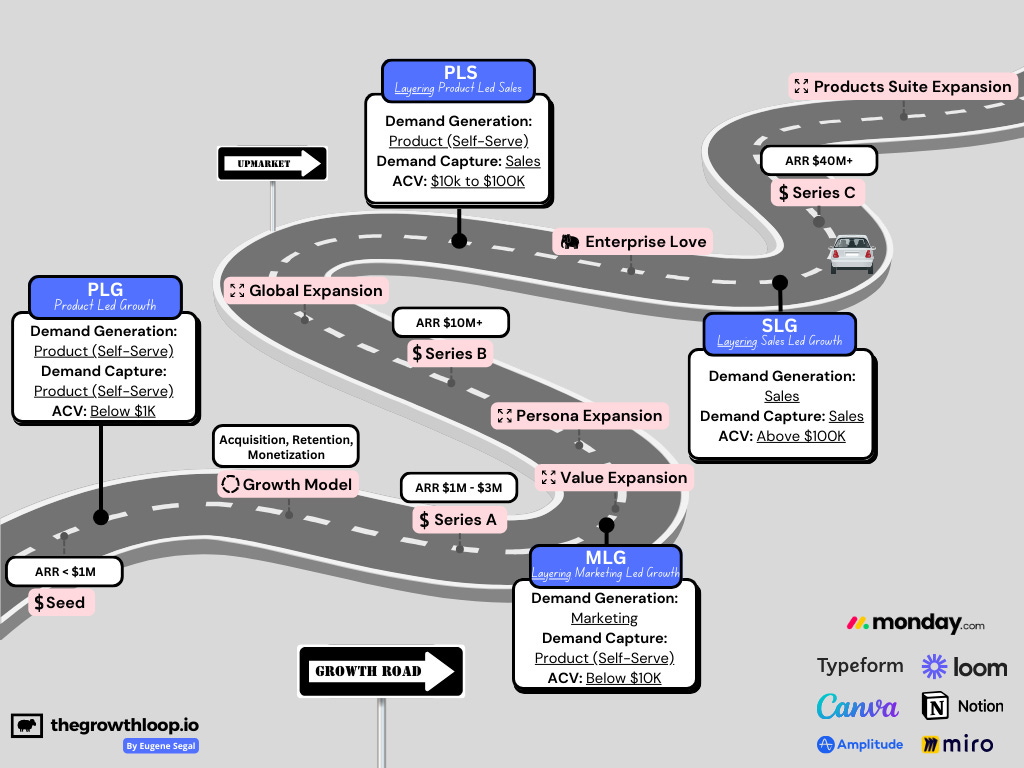

The Road From ‘0 to $100M ARR’

A step-by-step blueprint for B2B SaaS Founders and Growth Leaders

Did you know less than 3% of SaaS companies reach the $100M+ ARR1 club?

It’s a long and hard journey. How long? Well, ten years is considered fast.

Growing your company to $100M+ is a true emotional turmoil. It doesn’t matter how bright you are; shit will hit the fan constantly. No fancy growth advisor or ex-Google exec hire will solve it. 💩

So what do you think you should do? You should try and control the amount sh*t flying your way by investing in Predictability. Understanding the ins and outs of structuring Growth Systems at every stage in your journey must be your priority.

Before we start, I want to ensure we speak the same language.

🤔 What the hell is a Growth System? In less than 30 sec.

Growth is about building Systems, not Hacks! Hence, Growth Systems.

Building Growth Systems to Generate Revenue Defensibly, Sustainably, and Predictably. Why? So you and your investors can sleep better at night ( = the ultimate goal). 🤣

Many mistakably argue that Growth = PLG (Product Led Growth). This is not correct. Growth is much more than just PLG. Growth layers multiple growth motions to acquire, retain, and mobilize users. PLG is just one of those growth motions. The others are MLG ( = Marketing Led Growth) and PLS (Product Led Sales).

Nevertheless, they do have something correct. PLG is THE starting point of your Growth journey; however, it’s insufficient by itself to get you to $100M+ ARR. We will see why in a bit.

Understanding the When, Why, Who, and How to layer those growth motions makes all the difference. And it’s exactly what we will explore in this blog post. 😉

☝️ Two more things:

First, you don’t do ‘Growth’ before getting to PMF (Product Market Fit). So, I assume your SaaS B2B ‘Unicorn in the Oven’ is post-PMF.

Second, although every company is nuanced, with its own one-of-a-kind growth and business models, companies that make the $100M+ ARR club have common patterns when approaching ‘Growth’.

In this article, I will talk to you about how I would approach evolving B2B SaaS Growth System based on best practices and patterns from companies such as Miro, Canva, Notion, and Slack and thought leaders such as Brian Balfour and Elena Verna so you can join the $100M+ ARR club members before 2060. 🤣

A ton of value is coming your way!

1️⃣ PLG (Product Led Growth) | ACV (Annual Contract Value) < $1K

⏰ When?

You reached PMF and have some money in the bank (Seed / Series A).

😵💫 Why?

You want to grow your ARR 10X in the next 2-3 years. So, you'll need to evolve your growth strategy beyond the founder-led growth and random WoM2, you have been doing until now. You need a predictable and repeatable growth system.

😶🌫️ Who?

You can start with your narrow ICP3, focusing on providing value to individual users. You are not chasing unicorns but SMBs (1 to 100 employees). Take it easy.

😧 How?

You start with PLG. In PLG, the product generates demand ( = acquires new users) through virality and UGC4. Moreover, the product also captures the demand ( = monetizes those users) through the Activation, Engagement, and Monetization motions. Right now, the product is all you have. 😜

Start with setting up your Growth infrastructure, such as the data pipeline experimentation system, so that you can start iterating on your PLG hypotheses. Your goal should be to develop a growth model (micro and macro loops) around Acquisition, Retention, and Monetization that produces predictable and repeatable growth. It will be the base for your future growth!

You will go through many cycles of optimizing the growth model loops and innovating the model by adding new loops. How long? Don’t aim for less than two years.

🟢 Work with me!

There are three ways we can work together. Check those out. 😉

2️⃣ MLG (Marketing Led Growth) | ACV < $10K

⏰ When?

You have a stable growth model and start getting an influx of low-intent users. Hence, your Retention and Monetization metrics drop because your product can’t properly Activate and Retain those users.

😵💫 Why?

You want to balance between demand generation and demand capture.

This means being able to generate significant demand ( = acquiring many more uses) and effectively capture value from them by Retaining ( = making sure the Activation and Engagement metrics don’t drop) and Monetizing( = making sure the conversion from Free/Trial to Paid doesn’t drop).

All that while accelerating the monetization cycles ( = getting paid faster). 😅

😶🌫️ Who?

You are extending your ICP definition and targeting SMBs and mid-market players (101 - 1000 employees). You want to start entering those high ACV (Annual Contract Value) logos early on and build up your foothold with those logos’ end-users.

You aim to provide value to individual user levels and teams, setting the groundwork for PLS (Product-Led Sales) in the next growth stage.

😧 How?

Add new Acquisition loops ( = Performance Marketing) so that both product and marketing will generate demand ( = More acquisition channels).

Increase your demand generation by globalizing your offering and localizing your product to capture global demand properly. 🌎

Add Retention and Monetization loops through Lifecycle, Education, Community, Content, etc.

Unlock team-level value by extending to adjacent use cases within your ICP and expanding your initial ICP definition. You must ensure it makes sense for a team (not only individual users) to use your product. Don’t fake it; it should be real team value. At Miro, it’s the collaboration magic bullet; at Slack, it’s the direct network effect ( = the more users within your team using Slack, the more valuable Slack is for those users).

You will probably need to raise Series B to fuel the spending on R&D, Marketing, and ‘Headcount’ ( = I hate this word).

3️⃣ Layering on PLS (Product Led Sales)| $10k to $100K ACV

⏰ When?

You observe a significant usage within multiple logos in the mid-market and enterprise segments.

😵💫 Why?

You observe a clear benefit in high touch5 telling your product's value story. Going upmarket6, your story must convey how your product provides individual, team, and company-wide value.

You observe monetization friction (Credit Card limits, procurement processes, etc.) when closing high ACV accounts (above $10k - $20k) in Self-Serve7. You need a high touch to help the deal go through and capture the demand.

😶🌫️ Who?

You are going upmarket (not the whole way, though), focusing on mid-market and the lower end of the enterprise segments. Expanding those logos will get you those high ACV, high NDR8 ( = Net Dollar Retention) yummy deals your investors are bugging you about.

😧 How?

Build the PQA (Product Qualified Accounts) pipeline. PQA is a score you give a mid-market / enterprise account to set the probability of Sales expanding this logo. The score is based on a bunch of real-time Product signals. The secret source is in how you define those signals. 😉 And yes, it’s the Product that is generating demand.

Remember, those signals wouldn’t be there in the first place if you hadn’t started with PLG and continued layering new growth motions.

Set up your sales operation. Sales are capturing the demand in PLS. Once the magic PQA bulb goes on, it’s your Sales team show time. Your Sales team can reach out to the buyer persona ( = the person that actually makes the buying decisions) and do their thing.

Be aware that having the PQA bulb on doesn’t guarantee success; you must work the account. It does make it easier, however. Especially if the buyer persona is already a user. 🔥

You are going upmarket, and this adds complexity. The good news is that you are still not chasing those high-end enterprises. So, you can gradually layer on the different facades of the complexity of the enterprise segment.

Product Complexity: Balancing between the enterprise roadmap (security, permissions, reporting, documentation, etc.) and the Self-Serve roadmap

Process Complexity: Balancing between the slow enterprise GTM / Success / Support / IT cycles and the fast Self-Serve segments iterations cycles.

Cultural Complexity: Balancing between the Sales focus and User focus.

4️⃣ Layering on SLG (Sales-Led Growth) | ACV > $100k

⏰ When?

You have been running the PLS pipeline for some time and iterated on the enterprise product offering. You are ready to take on the additional complexity of layering on the SLG.

😵💫 Why?

Many enterprise-grade companies (tech giants, financial institutions, healthcare, government, etc.) have strict external software procurement policies, so you can’t penetrate those giants with initial usage. No initial usage = no PLS. Hence, you must layer on the traditional sales motion (SLG) to generate demand.

😶🌫️ Who?

You continue the upmarket journey, this time the whole way through. 😎 Focusing on the entire spectrum of the enterprise segment.

😧 How?

Set up your high-touch pipeline. It’s the MQL9 ( = Marketing Qualified Lead) to SQL10 (Sales Qualified Lead) operation in which Marketing and Sales drive the show. Sales (and Marketing) generate demand, and Sales captures the demand.

SLG is expansive. You will probably need this Series C to make it happen. Nevertheless, the monetization loop is fast; you can scale it, and the retention with the high-end enterprise segment is through the roof.

Continue navigating through the product, process, and cultural complexity that comes with the territory. The higher you go, the more restrictive it gets.

😉 The bottom line:

To reach the $100M ARR mark, you must go upmarket and get those yummy $100K+ contracts.

However, just as in the academic world, where you don’t start your journey by writing a Ph.D. thesis but with a bachelor's degree, in a B2B SaaS startup world, you don’t begin by chasing unicorns 🦄.

You start by targeting SMBs through PLG motion and gradually layering on complexity and additional growth motions (PLM, PLS, SLG) while going upmarket. Not the other way around!

PLG is the base for your growth.

PLG is how you get the initial footstep into those high ACV prospects.

PLG is your competitive advantage when capturing enterprise demand high touch ( = sales).

Getting upmarket can take 3 to 5 (or more) years.

Have patience. 🙏

Eugene Segal

ARR: Annual Recurring Revenue

WoM: Word-of-Mouth

ICP: Ideal Customer Persona

UGC: User Generated Content

High Touch: Human Interaction with the Prospect or the Customer.

Going Upmarket: Targeting prospects with higher ACV (Annual Contract Value)

Self-Serve: Without human involvement

NDR (Net Dollar Retention) - Measures the net revenue leftover in a set period, considering the total revenue minus any revenue from downgrades or churn, plus revenue from expansion due to upsells, cross-sells, and upgrades.

MQL (Marketing Qualified Lead) - A prospect which the marketing vetted as to being interested in the product.

SQL (Sales Qualified Lead) - A prospect that, besides being interested in the product, shows the intent to buy. Ready for the Sales process.